Unique Tips About How To Settle An Estate In Florida

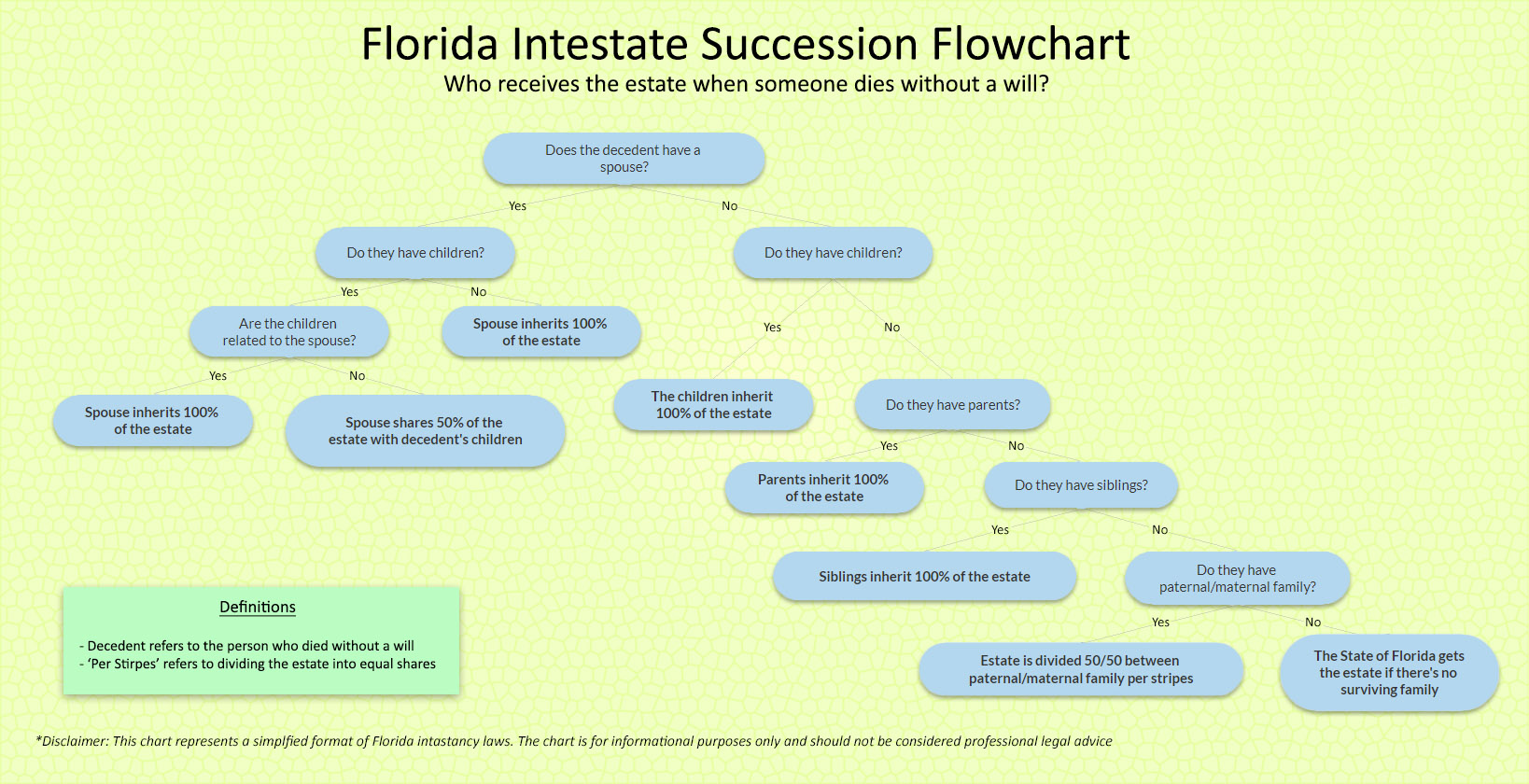

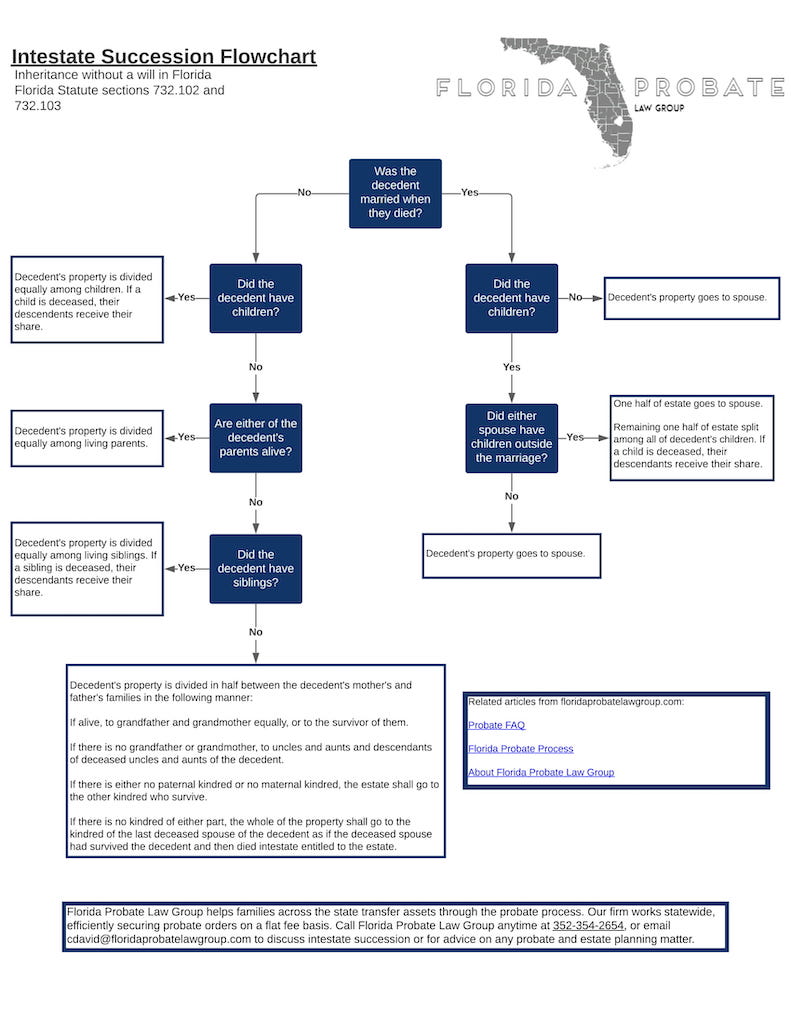

Florida’s intestate laws will pass the decedent’s probate estate to other, more remote heirs if the decedent is not survived by any of the close relatives described above.

How to settle an estate in florida. If there's a will, it must be filed. You’ll want to keep track of both your expenses and all the time you spend working. Must be in writing and state the applicable florida law (i.e., florida rule.

If the estate qualifies for summary. Florida law also requires an applicant to seek a qualified attorney who. Creditors have a statutory threshold of at least 90.

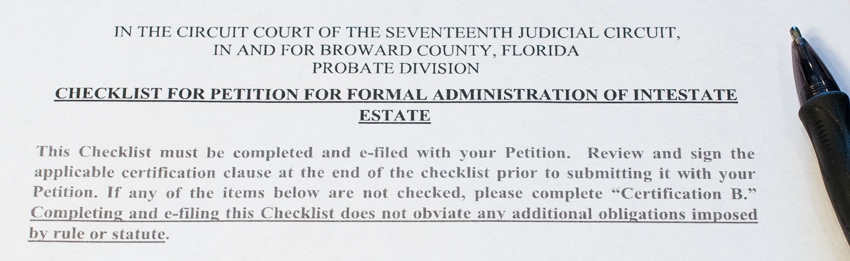

Specifically, a florida rules of civil procedure proposal for settlement must comply with the following: Florida law and federal laws specify that the fiduciary must file a notice of trust with the probate court, obtain an ein for tax issues, deposit the last will and testament with the probate court if. Up to 25% cash back the court issues a document called letters of administration, which gives the personal representative authority to settle the estate.

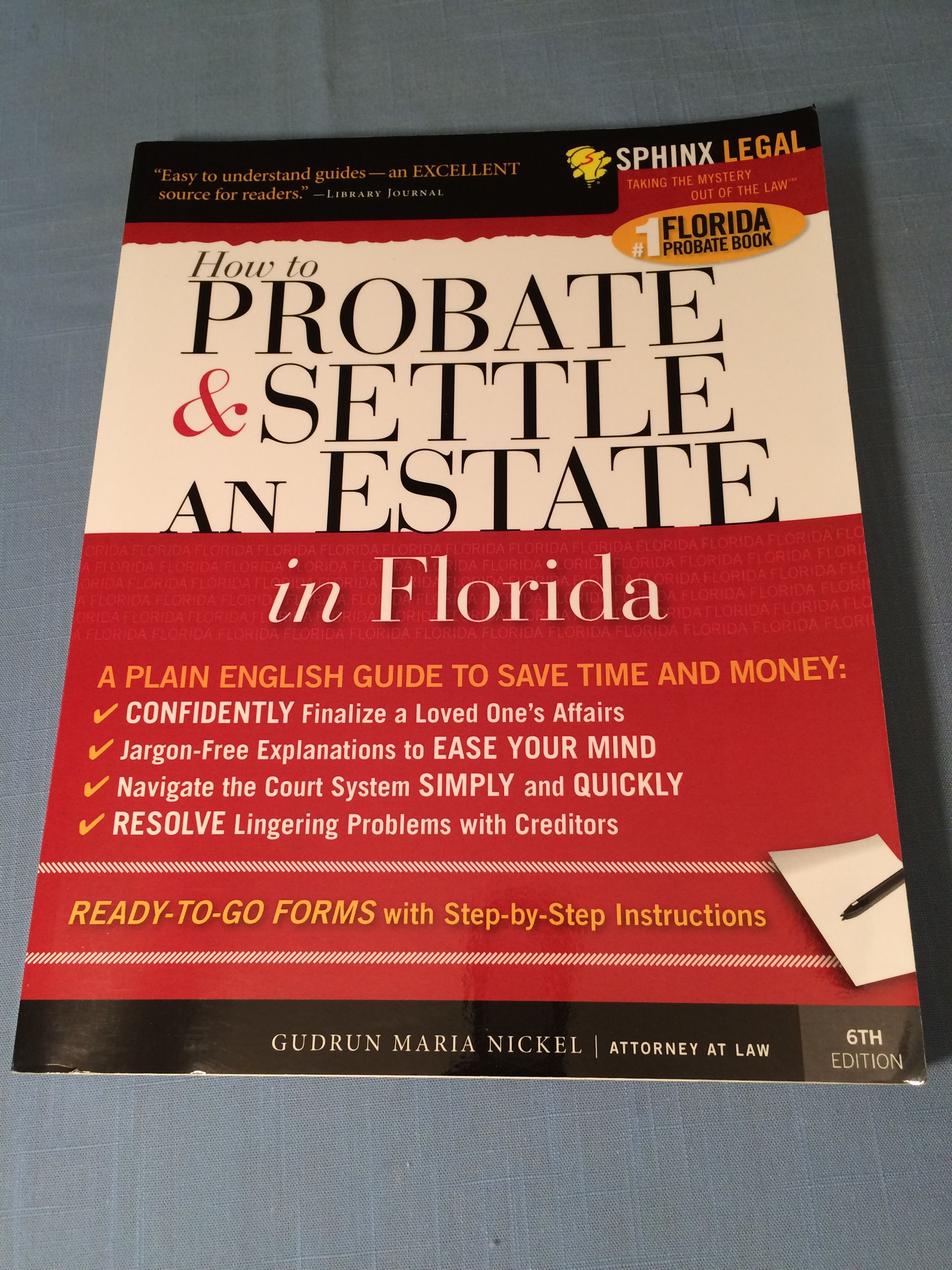

How to probate and settle an estate yourself, without the lawyer's fees : A will is a legal document setting out who will be beneficiaries of your estate, how and when they receive their inheritance. Settling an estate means filling out a lot of forms.

To become an executor in florida, you must file an application for administration for an intestate estate. How to probate and settle an estate in florida (2003 edition) | open library it. In florida, regardless of whether there is a will or not, you do need the services of an attorney to help settle an estate.

Lock all real estate premises to keep the. Any person who is 18 years of age or older and who is. Specifically, in the state of florida, an attorney is required.

![Probate Fees In Florida [Updated 2021] | Trust & Will](https://images.ctfassets.net/hs31rjjuxuuc/5SjFc0RdlCGJmsnN2gGapG/ce63438cfddc17f6dbe32546e3aa2f25/Probate_Blog_50states_Florida-min.jpg)